Balancer

AMM with flexible pools and ve-Token with fee share

Type:

DeFi

Token Strength

Governance, Yield bearing for ve-Version.

Governance: decide over treasury, fees and liquidity mining rewards. Voting escrow (veBAL): 75% of protocol fees are paid to veBAL holders.

Fees accrue to treasury and token holders decide over usage.

Low gas decentralised exchange, split of vault and pool logic leads to potentially deeper pools, flexibility of pool weighting.

Loading...

Our Take

- Smaller DEX by TVL with interesting technical implementation of pools

- Most of cheap, early tokens have been unlocked by now

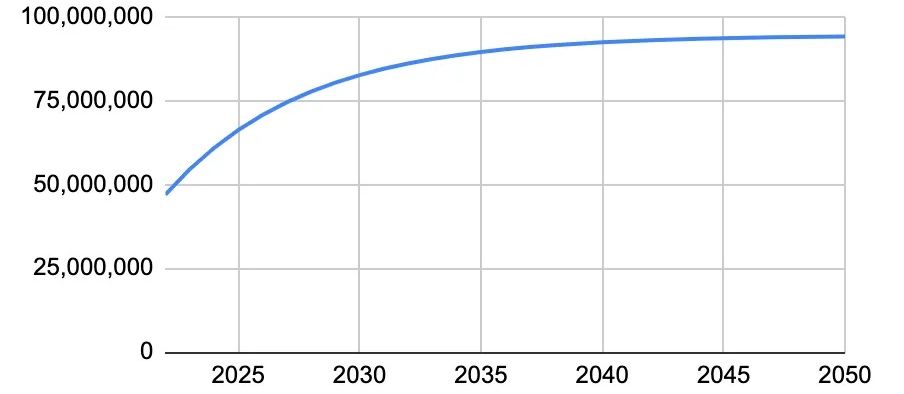

- However, more than 50% are still to be unlocked

- Interesting VE implementation where not the main token BAL is lock but the liquidity token, received for adding to the BAL/WETH pool. This ensures liquidity

- Exciting yield bearing token that shares part of the fees with VE token holders

Deep Dive

Supply Breakdown