Cult DAO

Cult DAO is a Venture DAO fully owned by the community. Cult DAO benefits token holders and stakers in the ecosystem through investment based on community voting and strong deflation mechanism. 1. Stake tokens and initiate an investment proposals (Guardians, top 50 stakers) 2. Stake tokens and vote on the investment proposals (The Many, other stakers) 3. All $CULT transactions incur a 0.4% fee. (Each transaction, everywhere, is charged a 0.4% tax in $CULT, which will be sent to the treasury) 4. Invest $CULT in approved portfolio projects (The funding for a single project is the $CULT worth 13ETH sent from the treasury) 5. Burnt at the initial stage of investment as well as the time they get returns (When executing proposals, a small portion of $CULT is burned and most of the $CULT is sent to portfolio projects. And then the returns on investment will be exchanged into $CULT, and half of them will be burnt)

Type:

DeFi

Token Strength

Our Take

- Stakers in the ecosystem always benefit compared to other roles in the ecosystem and they do not need to pay the principal for the investment.

- Cult DAO only invest 13 ETH in each project for every approved proposal. This rule is implemented in the smart contract. Projects have rejected funding because the funding was too small.

- Cult DAO depends on Guardians to find investment projects. However, by proposing, Guardians can leverage resources that do not belong to them to serve their private interests.

- For The Many, the investments may lose money because the voting relies too much on Guardians’ personal reputation and promotion of projects rather than investment principles and strategies.

- Too many $CULT are burnt during the operation, which wastes a lot of available resources.

Deep Dive

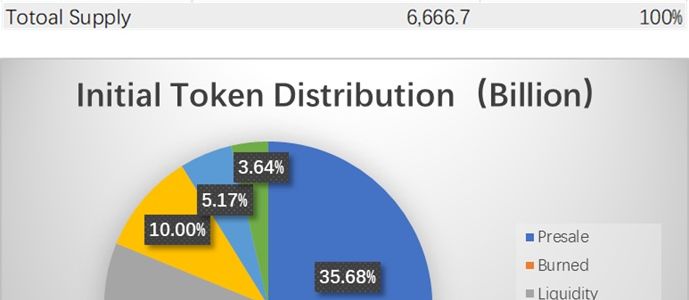

Initial Token Distribution

50% of tokens were allocated to the community in three rounds of sale, but only 71.36% of them (35.68% in max supply) were sold. The unsold tokens and a portion of $CULT, 24.52% in total, were burned at the beginning of the project’s launch.

20.98% of tokens were used for liquidity, while 10% share was reserved for development group. And there is a small portion of $CULT being gifted to some well-known figures as initial Guardians.

All tokens are unlocked after the presale except the team's share being unlocked linearly for 12 months.

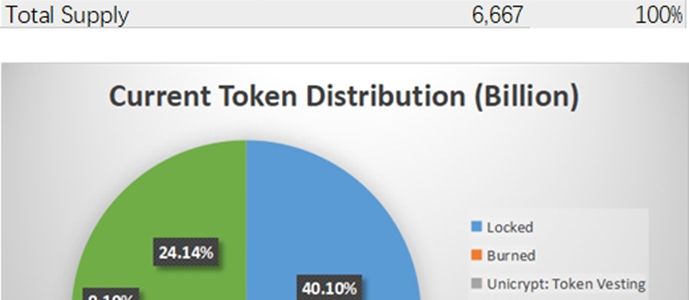

Current Token Distribution

The distribution as of 15 Nov 2022 is shown above. The percentage of token locked for $dCULT has reached 40.1% of max supply, which has gradually increased since launch and has become the largest demand factor at present. All burnt tokens have increased slightly from the initial period to reach 26.74%. Tokens on Unicrypt (Team & Initial Guardians) are gradually unlocked, and its percentage has decreased to 4.63%. Liquidity on Uniswap gradually stabilized to 4.21% while the share of Treasury has decreased to 0.19%.