Kilt Protocol

The KILT protocol is a layer 1 blockchain, specialising on self-sovereign identity - the management of identity and credentials or what Vitalik calls soulbound-tokens.

Type:

Layer1

Token Strength

Loading...

Our Take

- Super relevant technology and topic that could see use and adoption within industry

- Unsure if it's required among other SSI solutions native to blockchains such a Ethereum and even Bitcoin

- The community only governs over a supply of minted tokens that doesn't have any new inflows

- As most L1 the success will depend on adoption and use cases built on the ecosystem

Deep Dive

Allocation

Block Rewards

Vesting

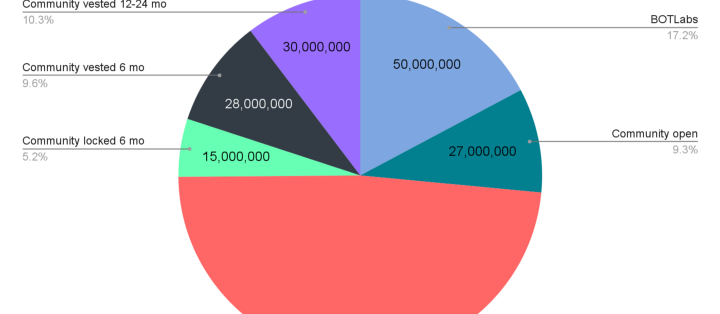

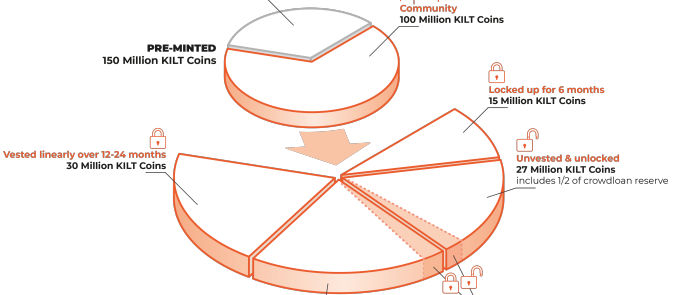

- At the TGE there will be 150 million pre-minted KILT Coins. All of these coins, regardless of being unvested, vested or locked, can be used in some governance and voting processes and can be staked for block rewards.

- 100 million of these coins are dedicated for the community. These coins have no lockup and no vesting; or a 6 month lockup; or linear vesting over 6, 12, 18 or 24 months.

- An amount of 4.5 million of these coins are reserved for crowdloan voting participants; some of which are unlocked linearly over 6 months after distribution.

- Fifty million coins are allocated to BOTLabs with a 60 months’ linear vesting.

- However, only about 34 million (23%) of the total number of coins minted at TGE will be in circulation after the Token Transferability Event (TTE) of the mainnet. This represents approximately 10% of the fully diluted distribution.

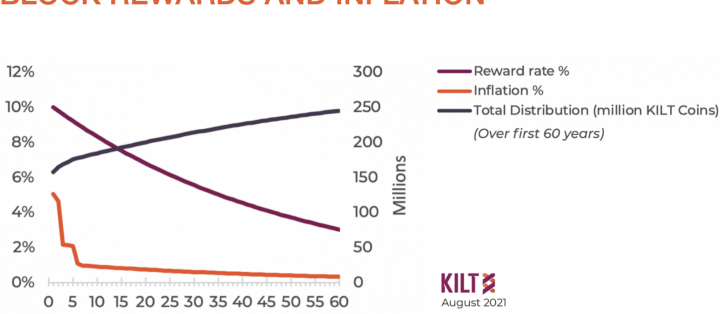

- After TGE, newly minted tokens are paid out to collators, delegators and the Treasury.

- The rate of newly minted tokens shall diminish over time (see details below).

- Therefore the distribution converges towards an asymptotic maximum of about 290 million KILT Coins (290,560,000).